How Our House Kits Help Entry-Level Homebuyers Build Wealth

Sky-high home prices show little sign of coming down, fueled by lower interest rates, maybe the post-Covid need for change, and current owners wanting to cash out at inflated prices. The reasons could be a dime a dozen. When demand is up, inventory is always tight. Such situations put homeownership out of reach for many, especially the Millennials rapidly entering their prime homebuying years. This means they are missing the opportunity to build lasting wealth through homeownership. Mighty Small Homes changes the game for the next generation of homeowners, making it possible to bypass the low inventory crunch. Robust and energy-efficient prefab homes from Mighty Small Homes create a pathway to homeownership.

Home Equity is the Key to Wealth Building

Building wealth through homeownership has always been an age-old investment practice and remains relevant today. As per U.S. Census Bureau, home ownership accounts for about 83 million units out of 126 million total occupied units. That's compared to 142 million units for a 65% ownership rate. Home equity indicates the difference between the value of your home and what you owe the lender. The more equity that is built, the more wealth the homeowner can eventually cash out to either purchase a new home or reinvest elsewhere, such as leveraging the equity in rental property. There are other benefits of home equity. Mortgages carry lower interest rates with the home as collateral for the loan. Also, mortgage interest on a primary residence may be deducted from income taxes. The disparity in wealth between homeowners and renters has increased over time. A U.S. Census report found that homeowners' median wealth was 89 times higher than that of renters.

Homeownership vs. Renting

While there are more homeowners than renters in the U.S., ownership hit a low of 63% in 2016, a rate not seen since 1965. Since then, the ownership rate has recovered but remains below a historic high of 69% in 2004. You can recoup the equity in your home built up over time. Rent, however, is unfortunately gone forever. Besides social status, here are the other significant benefits of home ownership.

Considering Your Home As an Investment

If you have lived in a particular city or town for a long time, it makes sense to buy a house to feel financially secure. You identify with the city and its lifestyle and get a sense of belonging. You feel that you have finally arrived. It is a sense of accomplishment in life. Buying a home also means that you are enhancing your wealth over time. It's a fact that property prices usually appreciate over the long term. Any delay in your property purchase will result in having to invest higher amounts. It also adds to your financial burden in addition to having paid rent over an extended period till you buy your own property.

Being in Control

With your own home, you have much control and freedom. Primarily, you do not have to deal with a landlord. Renters rely on landlords for repairs and other eventualities. And then there are the neighbors above playing the drums. When you own your home, you are empowered to make all decisions.

Emotional Well Being

Your own home offers emotional security. When you own a house, you provide your family with their own space – "A Home." That's a big deal. At the end of a long day, following a tiresome commute, your own nest offers priceless comfort.

Added Security

In a 2021 Census Bureau Survey (before the latest federal eviction moratorium was imposed), an estimated 3.6 million households were likely to face eviction. If you have your own home, there is less uncertainty and fear of an untimely eviction. While homeowners and renters experienced a loss of income during the COVID-19 pandemic, renters are more likely to face housing cost burdens as defined by federal legislation.

Matching Expectations

Renting often involves compromises on location, size, amenities, and cost. Additionally, there is the annual renewal of the rental agreement and the renegotiating terms – if you have that option. More often, the renewal amounts to take it or leave it. When you buy a home, you ensure that your chosen property meets your expectations.

Easy Financing Options

Owning your dream home has become much easier with the availability of financing options. You need not wait till you are 40 or 50 years old to accumulate enough wealth to buy your own dream home. You have options to buy it in your 20s or 30s. It would help if you chose a home loan lender who can offer flexibility in managing your home loan repayment by tailoring your home to suit your present and future income patterns.

Fees

Other costs factor into renting beyond the monthly fee. The security deposit you pay doesn't earn interest if it is returned. About 25 percent of renters don't get their security deposit refunded, according to Rent.com.

Tax Advantage

Your home loan principal amount and interest repayment fetch attractive tax breaks. Homeowners can deduct a portion of the interest paid on their mortgage each year from their federal taxes. They can often deduct their property taxes as well.

Fixed Payments

Your rent can change nearly any time, depending on your lease terms. However, a mortgage offers fixed-rate payments that never change unless you are late or decide to refinance into a new mortgage.

How Our House Kits Help More People Build Wealth

America's low housing inventory crisis, and the booming real estate market created a perfect storm for those seeking to become first-time homeowners or to buy a new home. What's available is not affordable. First-time homebuyers or entry-level homebuyers face more significant hardship. In these conditions, prospective homeowners must consider alternatives to buying new homes so they can begin building personal wealth with a stable real estate investment. One such option is building a home with a prefab house kit from Mighty Small Homes. A Mighty Small Home offers a quick building process for a robust and energy-efficient home. That means a secure home with low utility costs. Some buyers of kits from Mighty Small Homes perform some or all of the assembly, which saves additional costs, creating sweat equity. The most incredible benefits of a prefab home are the high energy efficiency—their tight seams and state-of-the-art windows, the effects of heat in summer and cold in the winter. Prefab homes can withstand many natural disasters and are eco-friendly with sustainability options.

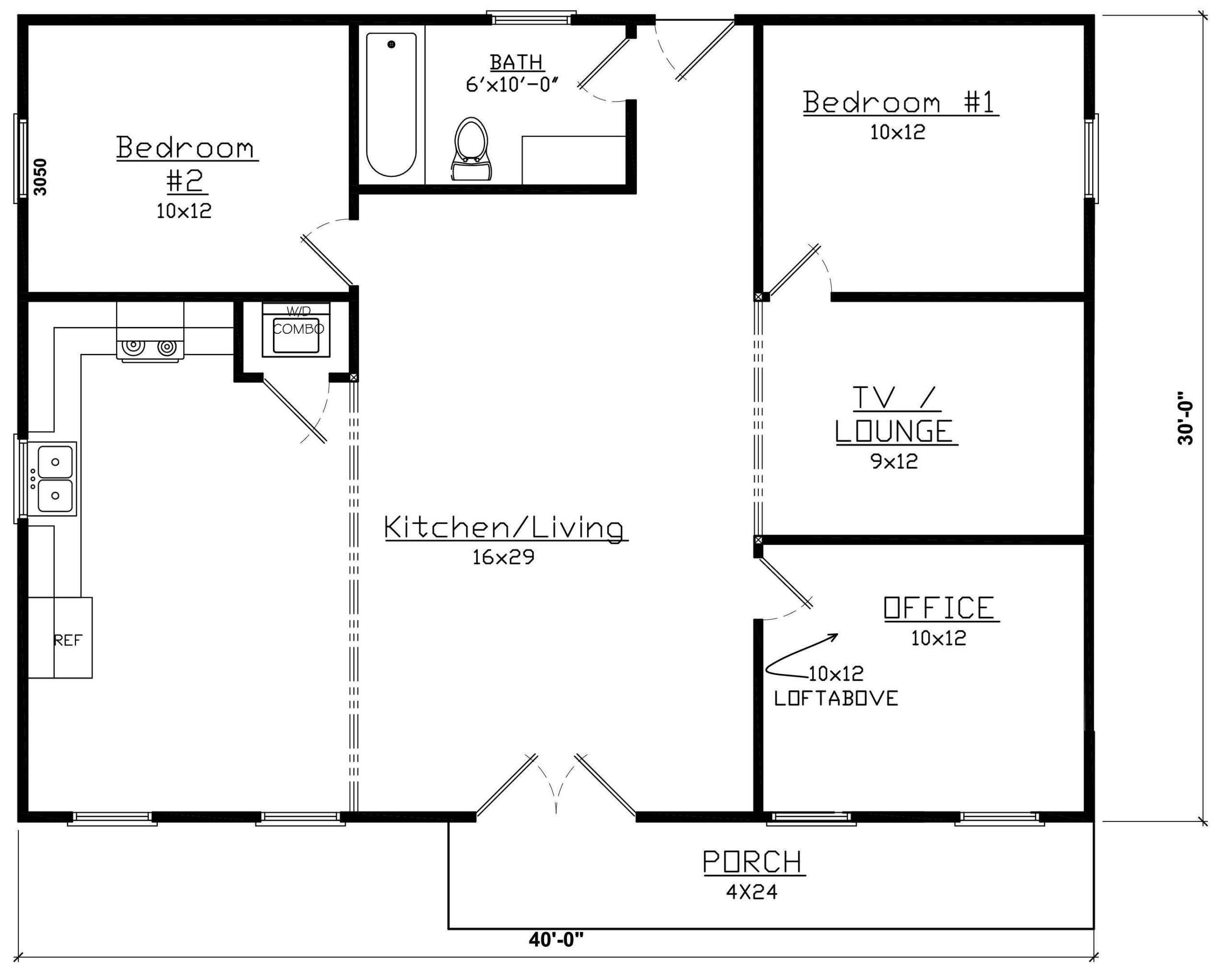

Customizable Floor Plans

The best advantage of home kits is that they can fit on lots of nearly any size or dimension. This benefit offers more flexibility in choosing a lot for your Mighty Small Home. The prefab kits come in several styles in sizes ranging from about 700 square feet to 1,500 square feet.

- The Modern - Features clean lines, large windows, and a functional layout that can be customized to match your lifestyle.

- The Carriage - A two-storied carriage house equipped with a garage.

- The Contemporary- A modern style with an efficient, simplified floor plan, easily customized with lofts and floor plans.

- The Cottage - Offers a comfortable, rustic charm that can be customized to include a loft.

- The Ranch - This classic style offers simplicity and the versatility of open or traditional layout options.

These homes feature vaulted ceilings that offer space for a loft or storage. Floor plans can be customized for your needs and lifestyle.

Less Skilled Labor Is Required

M.S.H. home kits have many D.I.Y. options. Unlike stick-built homes, our prefab homes can be assembled without skilled home builders, often in one or two days. It takes fewer laborers to make a prefab move-in ready compared to a conventional home. Less skilled labor needed reduces your costs. Construction of prefab homes involves assembling different structural insulated panels (SIPs) panel components produced in a factory. The panels form the walls, floors, and roof.

Less Lumber Required

Prefab SIPs home construction uses 40-60% less lumber than stick-built homes – a plus at a time of volatile lumber prices. As traditional construction costs continue to increase, prefab SIP home projects limit building costs in comparison.

Zoning Laws Are Changing (Slowly)

Cities across the U.S. are modifying local ordinances and regulations to allow more home construction in places that used to prohibit them. Urban homes are in high demand. Cities, builders, and individuals are repurposing vacant or under-used urban land for affordable new-home construction. It's called infill building., and it's going strong as zoning laws change to accommodate more housing units. Purchasing a home is a reliable way to build personal wealth that provides security and prosperity in today's increasing economic turbulence. Mighty Small Homes offers the solution for entry-level homeowners who fear they can't afford to buy homes at current inflated prices. Industry experts predict rental demand will climb over the next five years, with many high-population areas already experiencing rental housing shortages.